Introduction

In today’s modern world, credit cards have become an essential financial tool. They offer convenience, security, and purchasing power. However, the journey of credit cards has been long and transformative. From their early origins to the digital age, credit cards have evolved significantly. This article explores the history of credit cards, their development over time, and their impact on the financial world.

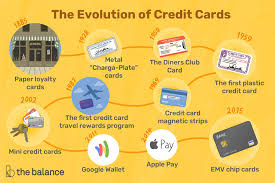

Early Forms of Credit

Before credit cards existed, various forms of credit were used in ancient civilizations. Merchants extended credit to trusted customers, and promissory notes were common in business transactions. In the 19th century, charge plates and coins were used as a form of credit, primarily in the United States.

The Birth of the First Credit Card

The first credit card concept emerged in the early 20th century. In 1950, the Diners Club Card became the first-ever charge card, founded by Frank McNamara and Ralph Schneider. This card allowed users to dine at participating restaurants without cash. The concept was revolutionary, and soon, other industries adopted similar systems.

The Rise of Bank Credit Cards

Following the success of Diners Club, banks began to see potential in credit cards. In 1958, Bank of America introduced the BankAmericard, which later became Visa. This was the first card that allowed revolving credit, meaning users could carry a balance and pay over time. Around the same time, MasterCard (originally called Interbank) was introduced, offering similar services.

The Expansion of Credit Card Networks

During the 1970s and 1980s, credit cards became widely accepted across various industries. Visa and MasterCard expanded internationally, while American Express and Discover entered the market with competitive offerings. Magnetic stripe technology was introduced, making transactions faster and more secure.

Technological Advancements in Credit Cards

With the advent of technology, credit cards saw significant improvements:

- 1980s: Introduction of the magnetic stripe for better security and convenience.

- 1990s: The rise of online shopping led to the need for secure online payments.

- 2000s: Introduction of chip-and-PIN technology (EMV) to reduce fraud.

- 2010s: Contactless payments and mobile wallets like Apple Pay and Google Pay changed how people use credit cards.

- 2020s: Advancements in AI, biometrics, and blockchain are shaping the future of credit cards.

The Impact of Credit Cards on Society

Credit cards have had a profound impact on global economies and consumer habits:

- Financial Inclusion: More people can access financial services without carrying cash.

- Convenience: Shopping and travel have become more seamless.

- Debt and Financial Risks: While credit cards offer advantages, they also lead to increased consumer debt and financial mismanagement.

- Security Enhancements: Innovations like tokenization and AI-driven fraud detection help protect consumers.

Challenges and Future of Credit Cards

Despite their benefits, credit cards face several challenges:

- Fraud and Cybersecurity Risks: Hackers and scammers continually find ways to exploit credit systems.

- Regulations and Compliance: Governments enforce strict rules to protect consumers.

- Competition from FinTech: Mobile payment platforms and cryptocurrencies are challenging traditional credit card systems.

The future of credit cards looks promising, with developments in blockchain, AI, and digital currencies leading the way.

FAQs

1. When was the first credit card introduced?

The first modern credit card, Diners Club, was introduced in 1950.

2. What is the difference between a charge card and a credit card?

A charge card requires full payment every month, while a credit card allows revolving credit with interest charges.

3. How did technology improve credit cards?

From magnetic stripes to chip-and-PIN, contactless payments, and digital wallets, technology has enhanced security and convenience.

4. What are some risks of using credit cards?

High-interest rates, overspending, and fraud are some risks associated with credit card use.

5. What is the future of credit cards?

The future includes AI-driven security, blockchain-based transactions, and integration with digital currencies.

Conclusion

Credit cards have come a long way since their inception. From simple charge cards to highly secure digital payment tools, their evolution has transformed the way we manage money. As technology continues to advance, credit cards will likely keep evolving, offering more security, convenience, and efficiency in financial transactions.